6 Common Use-Cases of Identity Verification

Today’s international regulatory environment is constantly fluctuating. As digitalization continues to penetrate an increasing number of industries, regulations –particularly in domains such as information privacy and Know-Your-Customer (KYC) policies –will have to progress to sustain. However, regulations typically evolve at a slower pace as compared to industry improvements. As a result, what is acceptable for a business to do today may become proscribed tomorrow.

Therefore, beyond simply following existing regulations, businesses must also try to expect the prospective regulatory environment and take steps to make sure they are protected above what is presently required.

One way to do so, particularly for businesses that are operating on the edge of innovation, is through dynamic KYC and identity verification standards that not only fulfill the current regulatory requirements but are equipped for the future as well. Such policies are the vanguard of protection against things such as scams and money laundering – the dark side of our ever more interconnected world.

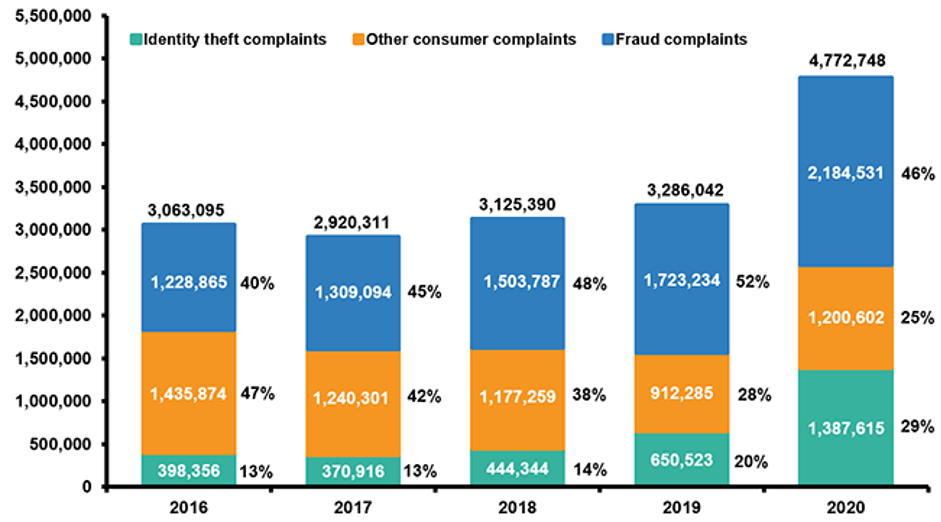

Source: Federal Trade Commission, Consumer Sentinel Network

Source: Federal Trade Commission, Consumer Sentinel Network

This is where digital identity verification can help as it brings the identity verification concept to today’s remote world. With increasing incidents of data breaches, account takeover attacks, and identity theft, and a greater demand for remote processes due to coronavirus, companies need to detect identity fraud and determine if somebody is actually who they claim to be online.

Let’s take a look at some of the possible use-cases of identity verification.

1. Financial services

Identity verification is more relevant than ever in the financial services industry. Not only it is the perfect solution to avoid identity-related fraud but also prevent the penalties for non-compliance with KYC/AML policies.

Simply put, an identity verification tool helps combat money laundering and fraud while helping financial organizations stay compliant. As a result, you can ensure that all financial transactions are secure.

An enterprise-grade identity verification solution is commonly used by:

· Wealth management companies

· Traditional banks and challenger banks

· Credit card companies

· Lenders

· Insurance firms

· Foreign exchanges

· Cryptocurrency and ICOs

· Payment providers

· Remittances

· Brokerages

· Investment platforms

Digitalization is helping all these organizations to enhance their customer experience, productivity, and efficiency. Unluckily, cyber-attackers have also started leveraging technology to find ambiguities in financial services and commit monetary scams. In fact, in 2019, around 62% of breached information came from financial services only. In the same year, 12 of the global top 50 banks were penalized for not complying with AML/KYC. The French Criminal Court imposed a fine of $5.1 billion on Swiss Bank for AML breaches.

Identity verification plays an important role in data security. It is quite useful in avoiding identity theft, money laundering, and other cybercrimes. Real-time digital identity verification tools can verify any identity document and analyze customers’ past records from the databases.

2. eCommerce and Retail

The eCommerce industry has become an easy target for cybercriminals. They are using several new methods to acquire consumers’ critical information and carry out different fraudulent activities.

According to a report, the most common kind of scam causing distress for eCommerce companies is identity theft. Although security protocols like SSL, firewall, and DSL are there, authenticating consumers’ identities is a big challenge for eCommerce companies. To deal with this challenge, companies need to have an appropriate identity verification setup in place that detects false ID documents and other particulars provided by the buyer.

Moreover, one of the biggest reasons customers abandon the website before completing the purchase is a lack of trust. Again, with a suitable identity verification system in place, companies can create more trust among their consumers and reduce cart abandonment. Also, businesses that focus on preventing identity fraud naturally enhance their reputation.

With an identity verification platform, eCommerce and retail companies can drive top-line growth and diminish fraud by verifying identities in real-time. As a result, you’ll be able to welcome genuine consumers with open arms.

Initially, identity verification used to be an expensive manual process that created friction for customers. However, with modern verification tools like Trust Swiftly, you can verify individuals quickly and easily on your website and mobile app. This way, you can reduce cart abandonment and Card Not Present (CNP) fraud with a seamless and safe checkout process.

3. Healthcare

Another major use-case of identity verification is the healthcare industry. Undoubtedly, with high-tech developments, the healthcare industry is growing quickly all around the world. Nonetheless, it’s also true that these developments have brought several risks to the industry.

Two of the main risks are identity theft and information breaches. Such threats not only put a patient’s medical record into the wrong hand, but failing to correctly identify patients may cause diagnosis and medication errors, which could be life-threatening.

Healthcare institutions can deliver services more successfully and efficiently by using digital identity verification. You can decrease overheads and safeguard sensitive patient information through smart identity verification processes.

Developments in telehealth and online healthcare record systems have established new opportunities to improve both the front and back office of healthcare providers and organizations. Yet, proper record keeping and strict access controls depend on precise identity verification processes.

With a robust digital identity verification tool, healthcare institutions can easily:

· Confirm patient identity for HIPAA requirements

· Protect patient information

· Process distribution of prescription medicines

· Avoid medical identity theft

· Onboard and register patients remotely

· Decrease wrong transfer, release, or updating of medical records

· Circumvent losses because of deceitful claims and incorrect billing

4. Government

Do you know, the US has lost about $200 billion due to fraudulent unemployment claims since March 2020? The major reason behind this loss is identity theft. Fraudsters use personal data taken during data breaches to file a claim with the stolen identities.

An identity verification tool helps government agencies deliver online public services securely and swiftly while making sure that sensitive personal identifiable information (PII) is never compromised.

Several government services can benefit from online identity verification, including:

· Applications

· Payments

· Communications

· Business registration

· Voting

· Employment programs

· Healthcare programs

· Surveys

· Taxes

Having precise and reliable identity data facilitates a new paradigm for government delivery, decreasing expenditures and increasing services through digital channels. Maintaining correct data records and carrying out methodical identity verification and background screening checks are indispensable practices for many public sector organizations.

From governments and regional councils to local authorities and state-run schools, a flexible identity verification tool like Trust Swiftly can make the process quicker, keeping public organizations fully secure and compliant.

5. Education

Schools and universities have had to move to online learning and fast-track digital transformation efforts because of the COVID-19 pandemic. However, this introduces new threats.

A robust identity verification tool can help schools, universities, and other educational institutions know with confidence that online learners are who they say they are, no matter their location. As a result, you can:

· Enhance quality and productivity of student services

· Serve a worldwide student population

· Maintain academic integrity of learners, faculty, and institutes

You can simplify the student enrollment process while avoiding the time and cost of authenticating every new student in person. Learners can complete the online identity verification process in just seconds. Moreover, many verification tools offer Liveness Detection, which ensures that the student creating an account, attending a class, or taking an online examination is physically present.

With an online identity verification process in place, the education industry can benefit in the following areas:

· Distance Learning - Know that only registered learners are attending classes and lectures.

· Proctoring Services - Verify students before online examinations.

· Colleges and Universities - Create a quick and easy registration experience for new learners, no matter where they are.

· Continuing Education - Guarantee remote learners are given proper credit for completed work.

6. Telecommunications

According to Communications Fraud Control Association (CFCA), identity or subscription fraud represents up to 40% of all fraud that occurs in the telecom industry. This can signify up to 10% of a mobile network operator's bottom line. Along with monetary damage, it also causes damage to their reputation due to poor customer experiences.

Subscription telecom frauds involve identity theft or the use of false identities at the point of sale, allowing either the deceitful use of telecom services or the use of such services for subsequent deceitful activities.

Identity verification has turned into an essential tool to identify and avoid fraud in every industry, and telecom is no exception. As telecom is directly or indirectly associated with numerous essential services like national security, health, and finance, identity verification is more important in this industry.

Although the telecom industry struggles with numerous identity risks –including call transfer fraud, vishing calls, and account takeovers –such threats can be diminished to a great extent using a flexible identity verification tool.

Effective identity verification is key to confronting telecom fraud. With a robust identity verification solution, telecom companies can prevent fraud, save time and money, and help ensure seamless customer experiences.

Key Takeaway

In the past, only select industries, such as banks, had to worry about identity verification and KYC. That’s no longer the case. Today, these are preconditions that have to be implemented across a wide range of industries.

From Fortune 500s to SMBs, Trust Swiftly helps companies meet compliance, decrease fraud, and build reliable relationships with consumers. That’s the unique advantage of our flexible identity verification platform, as it adapts to serve any sized business in any industry, accommodating new use-cases and workflows quickly. Get in touch to learn more.